EPR or FRT: Which Is the Better Value Stock Right Now? — Neutral

EPR FRT Zacks Investment Research — December 23, 2025Investors with an interest in REIT and Equity Trust - Retail stocks have likely encountered both EPR Properties (EPR) and Federal Realty Investment Trust (FRT). But which of these two stocks offers value investors a better bang for their buck right now?

CTSH or ACN: Which Is the Better Value Stock Right Now? — Positive

ACN CTSH Zacks Investment Research — December 23, 2025Investors interested in Computers - IT Services stocks are likely familiar with Cognizant (CTSH) and Accenture (ACN). But which of these two stocks presents investors with the better value opportunity right now?

Berger Montague PC Investigating Claims on Behalf of Investors in Coupang, Inc. (NYSE: CPNG) After Class Action Filing — Neutral

CPNG GlobeNewsWire — December 23, 2025PHILADELPHIA, Dec. 23, 2025 (GLOBE NEWSWIRE) -- National plaintiffs' law firm Berger Montague PC announces that a class action lawsuit has been filed against Coupang, Inc. (NYSE: CPNG) (“Coupang” or the “Company”) on behalf of investors who purchased or otherwise acquired Coupang securities during the period of August 6, 2025 through December 16, 2025 (the “Class Period”), inclusive.

JHX DEADLINE ALERT: Hagens Berman Alerts James Hardie (JHX) Investors to Today's Lead Plaintiff Deadline in Securities Class Action — Neutral

JHX GlobeNewsWire — December 23, 2025SAN FRANCISCO, Dec. 23, 2025 (GLOBE NEWSWIRE) -- National shareholder rights law firm Hagens Berman is issuing a reminder to investors in James Hardie Industries plc (NYSE: JHX) as the December 23, 2025, lead plaintiff deadline approaches in a pending securities class action against James Hardie and certain of its key executives. The litigation alleges that James Hardie senior management misled investors by touting “robust” and “normal” inventory levels, while allegedly aware that channel partners were aggressively destocking as early as April 2025.

Southwest's profits are down 42% this year but it's the top U.S. airline stock — Neutral

LUV CNBC — December 23, 2025Southwest Airlines profits are down this year, but its stock has gained more than any other airline this year. The carrier expects its initiatives like baggage fees and assigned seating to bear fruit next year.

Will Opendoor's "Default to AI" Strategy Deliver Real Returns? — Neutral

OPEN Zacks Investment Research — December 23, 2025OPEN's AI-led reset slashes costs, doubles acquisition speed, and aims for breakeven by 2026 amid a 1067.5% stock surge.

Will Serve Robotics' Gen-3 Robots Drive Faster Unit Economics? — Positive

SERV Zacks Investment Research — December 23, 2025SERV's Gen-3 robots slash production costs and boost autonomy, aiming to fast-track the path to stronger unit economics.

Can Coach's Luxury Strategy Sustain TPR's Competitive Edge in FY26? — Positive

TPR Zacks Investment Research — December 23, 2025Tapestry's Coach starts FY26 strong, with 21% y/y revenue growth in Q1, global demand gains and higher AUR from its accessible luxury strategy.

STOCKHOLDER ALERT: Pending Securities Fraud Lawsuit Against Integer Holdings Corporation (ITGR) — Neutral

ITGR Newsfile Corp — December 23, 2025Philadelphia, Pennsylvania--(Newsfile Corp. - December 23, 2025) - National plaintiffs' law firm Berger Montague PC announces that a class action lawsuit has been filed against Integer Holdings Corporation (NYSE: ITGR) ("Integer" or the "Company") on behalf of investors who purchased or otherwise acquired Integer securities during the period of July 25, 2024 through October 22, 2025 (the "Class Period"), inclusive. Investor Deadline: Investors who purchased Integer securities during the Class Period may, no later than February 9, 2026, seek to be appointed as a lead plaintiff representative of the class.

Rocket Lab Is Carving Out SpaceX Rival Status, Analyst Says — Positive

RKLB Benzinga — December 23, 2025Rocket Lab Corporation (NASDAQ: RKLB) is positioning itself as an alternative to SpaceX as customers push for more launch capacity.

Glancy Prongay & Murray LLP, a Leading Securities Fraud Law Firm Encourages F5, Inc. (FFIV) Shareholders To Inquire About Securities Fraud Class Action — Neutral

FFIV Business Wire — December 23, 2025LOS ANGELES--(BUSINESS WIRE)--Glancy Prongay & Murray LLP, a leading national shareholder rights law firm, announces that a securities fraud class action lawsuit has been filed on behalf of investors who purchased or otherwise acquired F5, Inc. (“F5” or the “Company”) (NASDAQ: FFIV) securities between October 28, 2024 and October 27, 2025, inclusive (the “Class Period”). F5 investors have until February 17, 2026 to file a lead plaintiff motion. IF YOU SUFFERED A LOSS ON YOUR F5, INC. (FFIV).

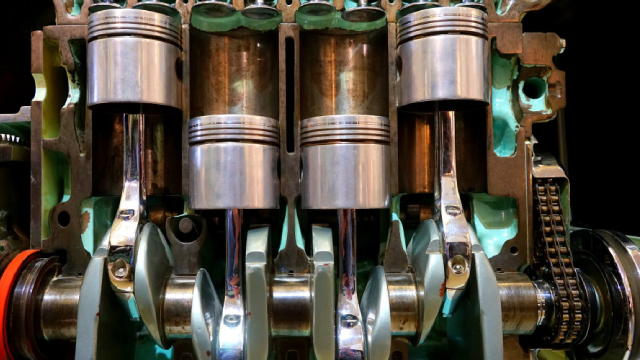

4 Manufacturing Tools Stocks to Watch on Prospering Industry Trends — Positive

CNM EPAC KMT SWK Zacks Investment Research — December 23, 2025Technological progress, digitization and strategic acquisitions favor the Zacks Manufacturing-Tools & Related Products industry's near-term prospects. SWK, CNM, KMT and EPAC are some promising stocks in the industry.

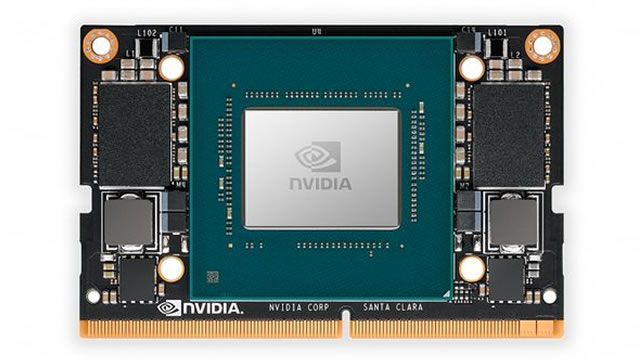

Nvidia's H200 AI Chips Get Trump's Nod for China Sales. Will Political Hurdles Derail the Plan? — Neutral

NVDA Investopedia — December 23, 2025Nvidia finally won President Donald Trump's approval to sell its H200 AI chips in China, but will it be able to seal the deal?

The Smartest Index ETF to Buy With $1,000 Right Now — Positive

QQQ The Motley Fool — December 23, 2025Tech and growth stocks continue to lead the market higher. The Invesco QQQ Trust is a great ETF to invest in to continue to play this long-term trend.

Gold's Trust Model Is Being Rebuilt Around Infrastructure, SMX Is Writing the Blueprint — Neutral

SMX Accesswire — December 23, 2025NEW YORK, NY / ACCESS Newswire / December 23, 2025 / For much of the modern gold trade, trust has been delegated to individual companies. Refiners certified their suppliers.

Making The U.S. Navy Great Again: Huntington Ingalls And Trump-Class Battleships — Positive

HII Seeking Alpha — December 23, 2025Huntington Ingalls Industries, Inc. stands to benefit from renewed U.S. naval investment, especially amid rising tensions with China and proposed "Trump-class" battleships. Upgrading the aging U.S. Navy is a bipartisan priority, with HII positioned as the nation's leading defense shipbuilder and likely recipient of major contracts. HII stock's valuation is not cheap (24.39x PE TTM), but its 1.16x P/S ratio and recent 16.1% Q3 revenue growth offer relative attractiveness.

EXCLUSIVE: Jay Woods Picks His Favorite And Least Favorite Magnificent 7 Stocks For 2026 – 'A Story To Watch' — Neutral

AAPL AMZN GOOG GOOGL META MSFT NVDA TSLA Benzinga — December 23, 2025The Magnificent Seven stocks continue to be among the most closely followed by investors, analysts and market experts. In an interview with Benzinga, Freedom Capital Markets Chief Market Strategist Jay Woods shares his favorite Magnificent 7 stocks heading into 2026 and which of the seven he's avoiding.

ServiceNow stock: Armis deal seen more than tripling its market opportunity — Positive

NOW Invezz — December 23, 2025ServiceNow (NYSE: NOW) investors may be concerned with the company spending $7.75 billion on buying Armis, but its CEO remains confident the deal will prove positive in the long run.

Tanger CEO on consumer demand: Customers are very resilient and looking to spend — Positive

SKT CNBC Television — December 23, 2025Tanger president and CEO Stephen Yalof joins 'Money Movers' to discuss the December consumer confidence data, consumer demand, and more.

The FCC just banned foreign drones and foreign drone parts from the U.S. Red Cat Holdings competes with foreign drone manufacturers. These 10 Stocks Could Mint the Next Wave of Millionaires ›