Wall Street Analysts Think Wix.com (WIX) Is a Good Investment: Is It? — Positive

WIX Zacks Investment Research — August 14, 2025When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Here's What Key Metrics Tell Us About Deere (DE) Q3 Earnings — Neutral

DE Zacks Investment Research — August 14, 2025While the top- and bottom-line numbers for Deere (DE) give a sense of how the business performed in the quarter ended July 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Is Walmart (WMT) a Buy as Wall Street Analysts Look Optimistic? — Positive

WMT Zacks Investment Research — August 14, 2025When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Marathon Digital (MARA) Is Considered a Good Investment by Brokers: Is That True? — Positive

MARA Zacks Investment Research — August 14, 2025When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Is Itron (ITRI) a Buy as Wall Street Analysts Look Optimistic? — Neutral

ITRI Zacks Investment Research — August 14, 2025The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Tapestry (TPR) Q4 Earnings: Taking a Look at Key Metrics Versus Estimates — Neutral

TPR Zacks Investment Research — August 14, 2025While the top- and bottom-line numbers for Tapestry (TPR) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Is It Worth Investing in PDD Holdings Inc. Sponsored ADR (PDD) Based on Wall Street's Bullish Views? — Positive

PDD Zacks Investment Research — August 14, 2025Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

SharkNinja, Inc. (SN) Is Considered a Good Investment by Brokers: Is That True? — Positive

SN Zacks Investment Research — August 14, 2025When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

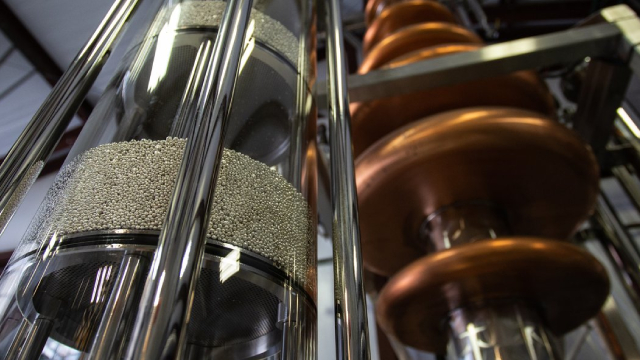

Wall Street Bulls Look Optimistic About Uranium Energy (UEC): Should You Buy? — Neutral

UEC Zacks Investment Research — August 14, 2025The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Investors Title Company: Counting Down To The Special Dividend — Positive

ITIC Seeking Alpha — August 14, 2025Investors Title Company remains financially robust, with a debt-free balance sheet and tangible book value per share over $135. Q2 results were strong, with net premiums written up 8% YoY and net profit of $12.3M, supporting continued profitability. The company's generous special dividends and capital allocation policy justify its premium valuation over tangible book value.

QQQH Could Be The Near Perfect Income Plan For Nasdaq-100 Investors — Positive

QQQH Seeking Alpha — August 14, 2025QQQH offers a defensive, actively managed collar strategy that outperforms traditional buywrite ETFs like QYLD in volatile and drawdown-heavy markets. The ETF provides superior drawdown protection and strong upside participation, making it ideal for income-focused investors seeking peace of mind and capital growth. With a sustainable 8.4% yield and favorable tax treatment under IRS Code Section 1256, QQQH balances income, risk management, and tax efficiency.

2 Of The Best Deeply Undervalued Retirement Dividend Growth Machines — Positive

ADC EPD EPRT ET KMI O OKE SCHD VNQ WMB Seeking Alpha — August 14, 2025Retirees tend to love stocks that combine big dividends, inflation-beating dividend growth, strong balance sheets, and durable and defensive business models. Even better, when retirees can buy these sorts of stocks at clear discounts to intrinsic value, they also can enjoy big upside potential. We share two of the best opportunities that check these boxes right now.

KBE: Quality Regional Banks ETF, Bet On The Health Of The U.S. Economy — Neutral

KBE Seeking Alpha — August 14, 2025KBE offers highly diversified, best-in-class exposure to regional and diversified banks, with a competitive expense ratio and solid dividend yield. The fund trades at a significant valuation discount to the S&P 500 and the broader financial sector, providing some downside cushion. Upcoming rate cuts and weak loan demand pose risks to margins, especially for regional banks more exposed to economic softness and consumer weakness.

Holding Imperial Oil Limited for Now: Here's Why it's Justified — Neutral

IMO Zacks Investment Research — August 14, 2025IMO offers robust returns, record production and growth prospects, but dependence on Exxon, weak chemicals and commodity swings can weigh on the stock.

Prediction: This Unloved AI Stock Has What it Takes to Outrun Nvidia in the Second Half of 2025 — Neutral

GOOG GOOGL 24/7 Wall Street — August 14, 2025Nvidia (NASDAQ:NVDA) stock continues to be the talk of the town.

Berger Montague PC Investigating Claims on Behalf of KinderCare Learning Companies, Inc. (NYSE: KLC) Investors After Class Action Filing — Neutral

KLC GlobeNewsWire — August 14, 2025PHILADELPHIA, Aug. 14, 2025 (GLOBE NEWSWIRE) -- National plaintiffs' law firm Berger Montague PC announces a class action lawsuit against KinderCare Learning Companies, Inc. (NYSE: KLC) (“KinderCare” or the “Company”) on behalf of investors who purchased or acquired shares during the period from October 6, 2024 through August 12, 2025 (the “Class Period”), including in or traceable to the Company's October 2024 initial public offering (“IPO”).

Exelixis Gains 15.6% YTD: How Should You Play the Stock? — Neutral

EXEL Zacks Investment Research — August 14, 2025EXEL rides on Cabometyx growth and zanzalintinib's trial success, but Q2 revenue miss and competition keep investor sentiment cautious.

Hasbro, Inc. (HAS) Hit a 52 Week High, Can the Run Continue? — Positive

HAS Zacks Investment Research — August 14, 2025Hasbro (HAS) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Countdown to Amer Sports, Inc. (AS) Q2 Earnings: A Look at Estimates Beyond Revenue and EPS — Neutral

AS Zacks Investment Research — August 14, 2025Evaluate the expected performance of Amer Sports, Inc. (AS) for the quarter ended June 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Intercorp Financial Services Inc. (IFS) Hit a 52 Week High, Can the Run Continue? — Positive

IFS Zacks Investment Research — August 14, 2025Intercorp Financial Services (IFS) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.