Are You Looking for a Top Momentum Pick? Why OPENLANE (KAR) is a Great Choice — Positive

KAR Zacks Investment Research — August 13, 2025Does OPENLANE (KAR) have what it takes to be a top stock pick for momentum investors? Let's find out.

Cathay (CATY) Upgraded to Buy: Here's What You Should Know — Positive

CATY Zacks Investment Research — August 13, 2025Cathay (CATY) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

SSR Mining (SSRM) is a Great Momentum Stock: Should You Buy? — Positive

SSRM Zacks Investment Research — August 13, 2025Does SSR Mining (SSRM) have what it takes to be a top stock pick for momentum investors? Let's find out.

All You Need to Know About Jabil (JBL) Rating Upgrade to Strong Buy — Positive

JBL Zacks Investment Research — August 13, 2025Jabil (JBL) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

Are You Looking for a Top Momentum Pick? Why InfuSystems Holdings, Inc. (INFU) is a Great Choice — Positive

INFU Zacks Investment Research — August 13, 2025Does InfuSystems Holdings, Inc. (INFU) have what it takes to be a top stock pick for momentum investors? Let's find out.

All You Need to Know About APi (APG) Rating Upgrade to Strong Buy — Positive

APG Zacks Investment Research — August 13, 2025APi (APG) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

Vulcan Rocket Brings New Era Of Space For United Launch Alliance: Will Boeing, Lockheed Martin Benefit? — Positive

BA LMT Benzinga — August 13, 2025A Vulcan Rocket from United Launch Alliance successfully lifted off Tuesday night as part of a mission for the U.S. Space Force's Space Systems Command.

Cava CEO Brett Schulman on earnings-fueled stock drop — Neutral

CAVA CNBC Television — August 13, 2025Cava CEO Brett Schulman on Wednesday said he feels good about the Mediterranean restaurant chain's business despite its second-quarter earnings report causing its stock to plunge Wednesday morning. "Stocks will go up, stocks will go down.

AT&T Opens New Regional Hub in Chantilly Marking Major Investment in Fairfax County — Neutral

T Newsfile Corp — August 13, 2025Fairfax County, Virginia--(Newsfile Corp. - August 13, 2025) - Last week, AT&T marked a significant milestone with the official ribbon-cutting ceremony for its new regional hub in the Chantilly-area of Fairfax County. The five-story, 111,000-square-foot office building located at 4807 Stonecroft Boulevard in Chantilly at the Westfields International Center at Dulles now serves as home to more than 500 AT&T team members and reflects the company's continued investment in innovation, collaboration, and the future of work.

Criteo: Setting The Stage For Sustainable, Margin-Accretive Growth Beyond The Noise — Positive

CRTO Seeking Alpha — August 13, 2025Criteo is successfully transitioning from a retargeting business to a diversified commerce media platform, with Retail Media driving structural, high-margin growth. Recent results show broad-based momentum, improved client retention, and a robust pipeline, supporting credible high single-digit topline growth through FY26–27. Margins are set to expand as investments in AI, self-service, and premium formats scale, with operating leverage expected to improve from H2FY25 onward.

Is the Options Market Predicting a Spike in Brookfield Business Partners Stock? — Neutral

BBU Zacks Investment Research — August 13, 2025Investors need to pay close attention to BBU stock based on the movements in the options market lately.

APLD vs. VRT: Which Digital Infrastructure Stock Has More Upside Now? — Positive

APLD VRT Zacks Investment Research — August 13, 2025APLD's AI-focused pivot, $7B CoreWeave deal and cooling tech give it an edge over VRT in the data center growth race.

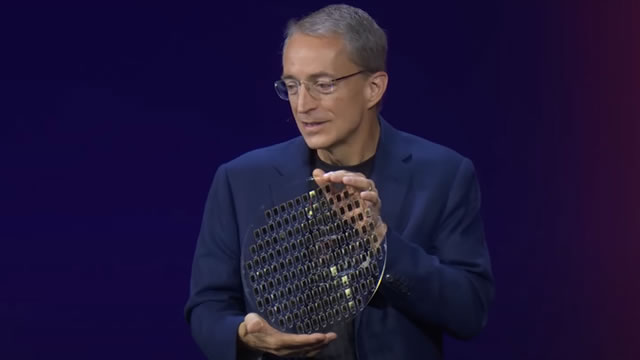

Jabil Skyrockets 119.6% in a Year: Should You Buy the Stock? — Positive

JBL Zacks Investment Research — August 13, 2025JBL's 119.6% surge is fueled by AI data center bets, strategic buyouts, and expansion into diverse high-growth markets.

Intel Rises 7.9% in the Past Year: Should You Buy the Stock? — Negative

INTC Zacks Investment Research — August 13, 2025Intel eyes AI PC boom with Core Ultra chips, but faces tough competition and slashed earnings estimates.

Should Investors Hold or Fold Oracle Stock at a P/E Multiple of 36.7X? — Neutral

ORCL Zacks Investment Research — August 13, 2025ORCL's cloud growth impresses, but rich valuation warrants caution. You can hold or wait for better entry points in 2025 as competition intensifies.

Top Stock Movers Now: Lennar, Gildan Activewear, CAVA Group, and More — Positive

CAVA GIL LEN Investopedia — August 13, 2025U.S. equities edged higher at midday on continuing optimism the latest consumer inflation data will open the door to the Federal Reserve to cut interest rates next month. The S&P 500 and Nasdaq added to their record closes yesterday, and the Dow Jones Industrial Average was higher as well.

Walmart expands grocery discount for 1.6 million employees as tariffs renew inflation concerns — Positive

WMT CNBC — August 13, 2025Walmart said Wednesday that it will offer a 10% employee discount on nearly all groceries. The employee discount previously applied to fresh produce and most general merchandise, such as clothing and toys.

INVESTOR ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of Groupon, Inc. - GRPN — Neutral

GRPN GlobeNewsWire — August 13, 2025NEW YORK, Aug. 13, 2025 (GLOBE NEWSWIRE) -- Pomerantz LLP is investigating claims on behalf of investors of Groupon, Inc. (“Groupon” or the “Company”) (NASDAQ: GRPN). Such investors are advised to contact Danielle Peyton at [email protected] or 646-581-9980, ext. 7980.

H&R Block's Q4 Earnings Miss Estimates, Improve Year Over Year — Negative

HRB Zacks Investment Research — August 13, 2025HRB's Q4 EPS miss contrasts with revenue growth as tax prep gains offset weaker financial services performance.

CoreWeave's Q2 Loss Narrows Y/Y, Revenues Up, Stock Down — Positive

CRWV Zacks Investment Research — August 13, 2025CRWV posts narrower Q2 loss, record revenue surge of 207% on AI-cloud demand. It lifts 2025 revenue outlook amid major customer wins.