Datadog (DDOG) fell 7.6% on heavy trading volume after a Truist Securities downgrade to ‘Hold' accompanied by a significant price target cut. This shift marked a sharp and aggressive retreat from recent peaks, driven by a wider market rotation away from high-growth technology stocks.

Dow, S&P 500 Log Records During First Full Week of 2026 — Positive

IVV SPLG SPXL SPY SSO UPRO VOO Schaeffers Research — January 09, 2026The new year is off to a wild start, with the Dow Jones Industrial Average (DJI) and S&P 500 (SPX) notching records earlier this week following the U.S. capture of Venezuelan President Nicolás Maduro, which boosted the defense and energy sectors.

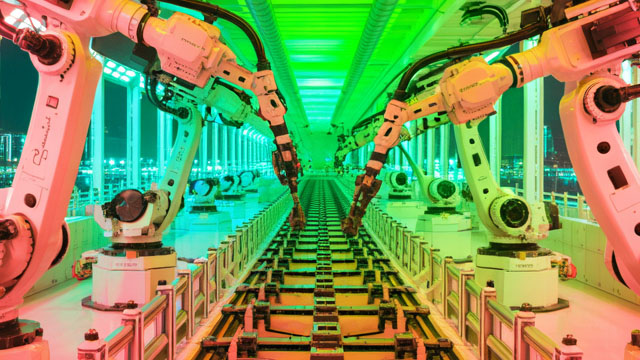

How Oceaneering Is Building a Scalable Robotics Platform — Neutral

OII Zacks Investment Research — January 09, 2026OII's subsea robotics segment delivers 99% uptime and global scale, anchoring a platform built for remote, data-driven growth.

Air Lease Reports Active Fleet and Sales Strategy in Q4 2025 — Positive

AL Zacks Investment Research — January 09, 2026AL advances its fleet strategy in Q4 2025, buying 10 new jets and selling 23 aircraft, boosting flexibility while investing $920M in modern planes.

Merck in Talks to Buy Revolution Medicines Per Financial Times Report — Positive

MRK RVMD Zacks Investment Research — January 09, 2026Merck is in talks to acquire RVMD, which could bolster its oncology pipeline, according to a Financial Times report.

Boyd Group Services Inc. Completes Acquisition of Joe Hudson's Collision Center — Neutral

BGSI PRNewsWire — January 09, 2026Solidifying Boyd's Position as a Leading Player in the North American Collision Industry WINNIPEG, MB, Jan. 9, 2026 /PRNewswire/ - Boyd Group Services Inc. (TSX: BYD) (NYSE: BGSI) ("BGSI", "the Boyd Group", "Boyd" or "the Company") today announced the closing of the acquisition of Joe Hudson's Collision Center ("Joe Hudson's"), the definitive agreement to acquire Joe Hudson's having been previously announced on October 29, 2025. The acquisition adds 258 locations across the US Southeast region, increasing Boyd's North American location footprint by 25% to 1,301.

Vera Therapeutics Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4) — Neutral

VERA GlobeNewsWire — January 09, 2026BRISBANE, Calif., Jan. 09, 2026 (GLOBE NEWSWIRE) -- Vera Therapeutics, Inc. (Nasdaq: VERA) today announced that, on January 5, 2026, the Compensation Committee of the Board of Directors of Vera Therapeutics granted inducement awards consisting of non-qualified stock options to purchase 228,750 shares of Class A common stock and restricted stock units (RSUs) underlying 116,000 shares of Class A common stock to eighteen (18) new employees under the Vera Therapeutics, Inc. 2024 Inducement Plan (Inducement Plan).

Pioneer Power Solutions, Inc. (PPSI) is a Great Momentum Stock: Should You Buy? — Positive

PPSI Zacks Investment Research — January 09, 2026Does Pioneer Power Solutions, Inc. (PPSI) have what it takes to be a top stock pick for momentum investors? Let's find out.

Aptiv PLC (APTV) Is Up 1.99% in One Week: What You Should Know — Positive

APTV Zacks Investment Research — January 09, 2026Does Aptiv PLC (APTV) have what it takes to be a top stock pick for momentum investors? Let's find out.

Regeneron (REGN) Upgraded to Strong Buy: What Does It Mean for the Stock? — Positive

REGN Zacks Investment Research — January 09, 2026Regeneron (REGN) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

Are You Looking for a Top Momentum Pick? Why Banco Santander (SAN) is a Great Choice — Positive

SAN Zacks Investment Research — January 09, 2026Does Banco Santander (SAN) have what it takes to be a top stock pick for momentum investors? Let's find out.

AN2 Therapeutics (ANTX) Upgraded to Buy: What Does It Mean for the Stock? — Positive

ANTX Zacks Investment Research — January 09, 2026AN2 Therapeutics (ANTX) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

What Makes Black Diamond (BDTX) a New Strong Buy Stock — Positive

BDTX Zacks Investment Research — January 09, 2026Black Diamond (BDTX) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Revolve Group (RVLV) Upgraded to Strong Buy: What Does It Mean for the Stock? — Positive

RVLV Zacks Investment Research — January 09, 2026Revolve Group (RVLV) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

Is the Apple stock pullback a buy opportunity? Analysts see near term upside — Positive

AAPL Invezz — January 09, 2026Apple shares extended a rare period of weakness this week, slipping 0.5% to $259.04 on Thursday and marking the stock's seventh consecutive session of declines dating back to Dec. 30. While the pullback has been relatively modest — Apple shares are down about 5.

Carvana (CVNA) Upgraded to Buy: Here's Why — Positive

CVNA Zacks Investment Research — January 09, 2026Carvana (CVNA) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

All You Need to Know About Corteva, Inc. (CTVA) Rating Upgrade to Buy — Positive

CTVA Zacks Investment Research — January 09, 2026Corteva, Inc. (CTVA) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

All You Need to Know About Rimini Street (RMNI) Rating Upgrade to Buy — Positive

RMNI Zacks Investment Research — January 09, 2026Rimini Street (RMNI) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

All You Need to Know About Ares Commercial Real Estate (ACRE) Rating Upgrade to Strong Buy — Positive

ACRE Zacks Investment Research — January 09, 2026Ares Commercial Real Estate (ACRE) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).