Stock Screeners

Over Valued Stocks

Have you heard of Michael Burry? The Big Short? - Well in maybe 2022 (?) he tweeted something about how there are all these companies out there with huge valuations that also lose tons of money. That is companies with over 1 Billion in market cap that lose over 100 million. That does seem silly, so we produced a list of all of those stocks.

The list is updated periodically as it doesn't change often. But it is a good idea to refer to this when doing your due diligence just so you know what kind of company you're considering. If the stock is on this list, then it might be overvalued, at least according to this criteria and with interest rates above 5% in 2023, it will be difficult for these companies to continue borrowing money, or at a minimum, their borrowing costs will go up significantly which will further erode the possibility for them to become profitable. These headwinds are real especially if we consider that interest rates look like they're staying higher for longer (well into 2024).

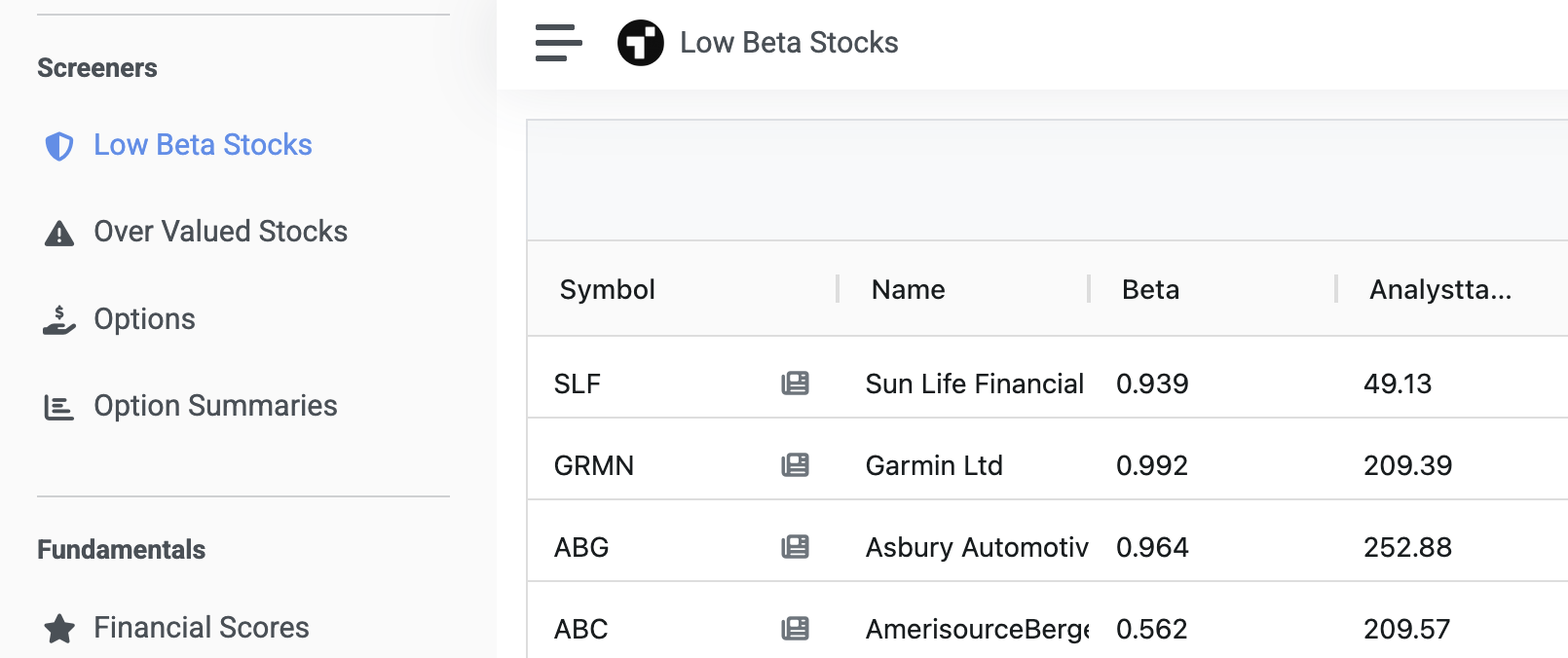

Low Beta Stocks

Often, when we're selling options, we want to sell options on stocks that have a low Beta. Stocks with low Beta tend to move in magnitude about equal to or less than the magnitude of the overall market. So if you have a stock with a Beta of 1, then it is expected to move with roughly the same magnitude as SPY.

Beta is not directional so if SPY goes up 1%, then it would be expected that a stock with a Beta of 1 would also move roughly 1% (up or down).

These are great for options sellers because their moves are more predictable. The option income will usuall be lower as a result.