Trade Journal

Think of the Trade Journal as your personal strategy study guide. It is your primary tool, as an investor, to create and refine your personal trading strategy.

The Process

When we want to learn to be better at playing chess, we study past chess matches. In fact, this is how Big Blue (IBM's first foray into AI) was created. It was trained on past chess matches from the very best.

Another step in the process of mastering chess, is for the player is to study their own chess matches. Matches are recorded for future review and by studying them, the player learns not only to master the game of chess, but also their own emotion. The player can look at the moves and reflect on their thoughts and emotion at that time. By doing that, the player is able to perfect their game.

Recording Your Moves

The Trade Journal is our way of recording our moves so that we can reflect on them at a later time and learn from them. Instead of having the results of a chess match, we have the results of our decisions calculated and displayed as statistics.

You'll record each opening and closing. You can use the links on the screeners in Tiblio to pre-populate most of the data you need to record opening trades. You have the option to record the trade with a tag which can be for a particular account or for a particular strategy. You can see results for all of your trades or grouped by individual tag.

Closing Trades

The Trade Journal updates statistics whenever you close a position. In order to close a position, be sure to edit an already open position and then use the close button to open a form and enter the closing details.

You can close a whole position or only part of it at a time. The Trade Journal should be very flexible and operate however you like to trade.

After you close the trade, the statistics across the top will update.

The Statistics

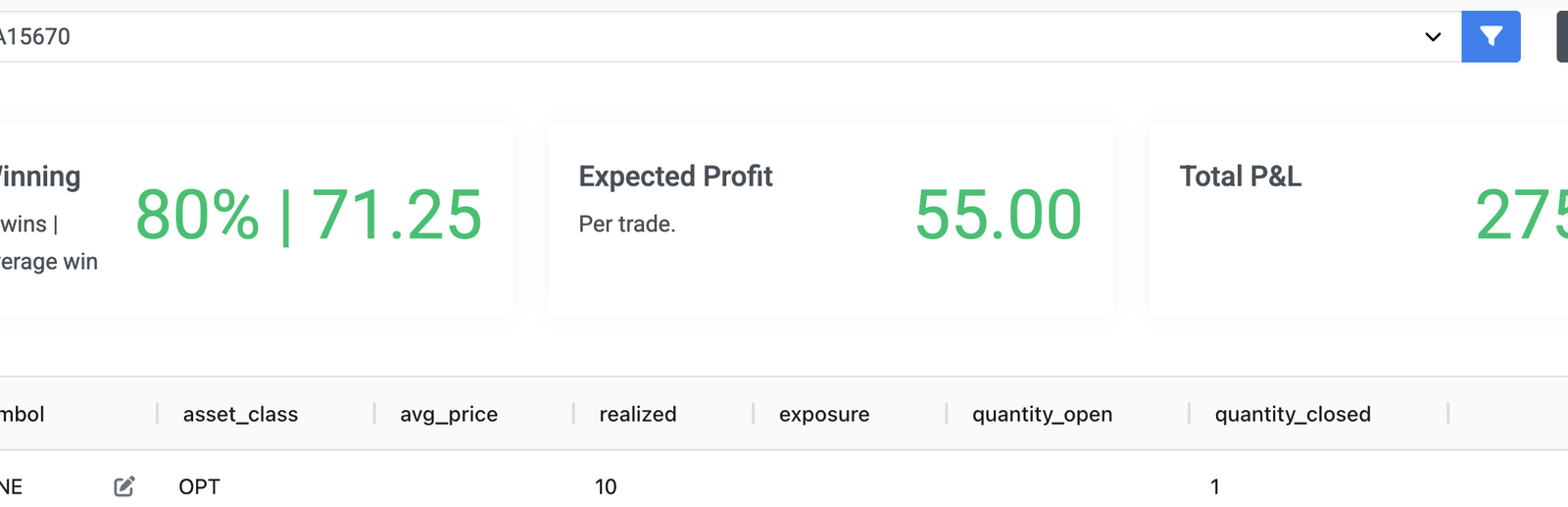

Across the top of the screener you have just a few primary statistics. We've worked hard to boil it down to the numbers that you need in order to perfect your trading strategy or quickly pivot from a strategy that just isn't working.

These statistics are:

- Win Percent: The percentage of the trades logged that resulted in a win and exactly how much of a win. If it is a losing strategy, this will show the loss.

- Expected Value: The win percent and win amount along with the loss percent and loss amount are used to calculate your expected value per trade. This is the dollar amount that you would expect to be the result of any given trade that you place and operate according to this strategy.

- Total P&L: Not always glorious or even nice to look at, but this is the ultimate number that tells you if this strategy is worth the time you're putting into it.

The Grid

Data in the Trade Journal grid is grouped by Symbol and Asset Class. This allows you to quickly peer deep into your strategy and see at a more granular level what parts of it are working and what parts are not. Not all stocks are well suited for all strategies. Even among successes, some will perform better than others in different strategies.

An interesting statistic presented in the grid is the AveragePrc. If you often trade the same option, then this will let you know quickly whether you're about to open a new position above or below your average for that equity. Opening positions above or below this average price will affect the statistics across the top.

How to use Probabilities

The expected value of one of your trades is the probability multiplied by the average profit (or loss). Because this is a probability, it doesn't indicate that every trade will result in this value. It indicates that over a large number of trades, then you would expect this amount of profit per trade. This also means that the Expected Value gets better with the more trades that you log.

It really does take a large number of trades. Don't under estimate that. The number one take away is that scaling is critically important. Your ability to place more trades means trading stocks that are right sized for your account. This also means that your strategy must be composed of repeatable trades.

A note on automatic trade logs

Automatically logging trades kind of defeats the purpose. If we automatically ingest all of your orders from your brokerage, not only are you totally tuned out and not paying attention, but we also don't know the intent behind the trades, so we have to guess, and that leads to issues. So it is best for you to form the habit of logging trades as you place them in your brokerage.