Options Screener Guide - Cash Secured Puts, Covered Calls & Vertical Spreads

Options strategies let investors generate income and manage risk. Three popular strategies include cash secured puts, covered calls, and vertical spreads. Each strategy serves different market conditions and risk profiles.

Cash Secured Puts

What Are Cash Secured Puts?

A cash secured put requires you to sell a put option. You collect money upfront. If the stock price stays above your strike price, you keep the money. If the stock price falls below your strike price, you buy the stock at the strike price.

You need enough cash in your account to buy 100 shares of the stock at the strike price. This cash serves as collateral for the put option you sold.

Why Sell Cash Secured Puts?

Investors sell cash secured puts for three main reasons:

- Income Generation: Collect money from selling put options while waiting for stock opportunities

- Stock Acquisition: Buy stocks at lower prices than current market value

- Risk Management: Set purchase prices in advance and get paid to wait

Covered Calls

What Are Covered Calls?

A covered call requires you to own 100 shares of stock and sell a call option against those shares. You collect money upfront from selling the call. If the stock price stays below your strike price, you keep the premium and your shares. If the stock price rises above your strike price, you sell your shares at the strike price.

The shares you own serve as collateral for the call option you sold. This limits your risk compared to selling naked calls.

Why Sell Covered Calls?

Investors sell covered calls for three main reasons:

- Income Enhancement: Generate income from stocks you already own

- Stock Exit Strategy: Sell shares at predetermined prices while collecting premium

- Portfolio Protection: Reduce cost basis of holdings through premium collection

Vertical Spreads

What Are Vertical Spreads?

A vertical spread involves selling one option and buying another option of the same type with different strike prices. Both options have the same expiration date. You collect the difference between the two option prices as premium.

For example, you might sell a $100 put and buy a $95 put. You collect the net premium but limit your risk to the difference between strikes minus the premium collected.

Why Trade Vertical Spreads?

Investors trade vertical spreads for three main reasons:

- Defined Risk: Maximum loss is limited to the spread width minus premium collected

- Capital Efficiency: Require less capital than cash secured puts or covered calls

- Risk Management: Limit downside exposure through the long option

Why Vertical Spreads Are More Challenging

Many traders consider vertical spreads easy to manage. This is wrong. Vertical spreads present unique challenges that make them more difficult than single leg options:

- Bid-Ask Spreads: You pay the spread twice - once when opening and once when closing

- Early Assignment Risk: Short option can be assigned while long option cannot be exercised

- Complex Greeks: Delta, theta, and gamma interact differently between the two legs

- Execution Risk: Both legs must be filled simultaneously for proper spread pricing

Using the Options Screener

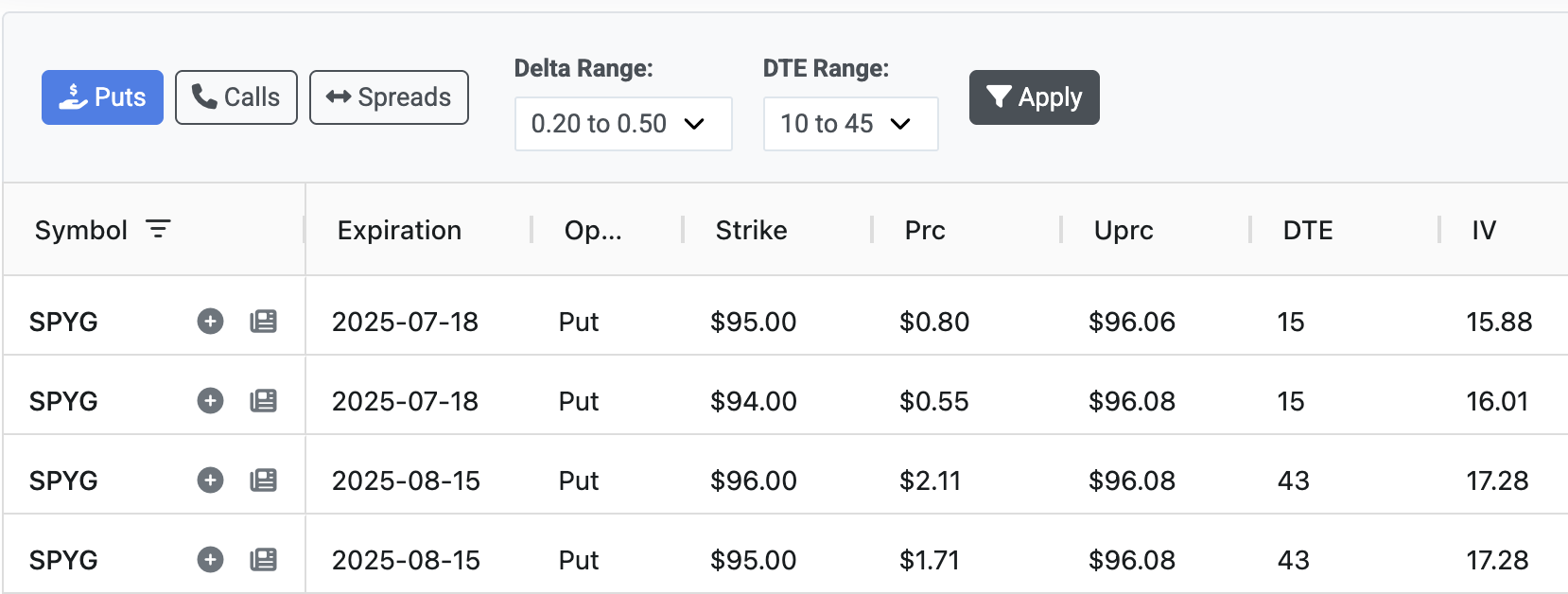

Tiblio's options screener updates every minute during market hours. The screener filters options based on your selected criteria and displays the best opportunities for each strategy.

The process works like this:

- Filter for options that match your strategy using a combination of column header filters and the Delta Range and DTE selectors

- Research stocks from the results list to find companies you want to trade

- Choose an option based on the your target return and risk of assignment

Symbols Included in the Screener

- All S&P 500 Constituents

- All Nasdaq 100 Constituents

- All Dow Jones Constituents

- 11 SPDR Sector ETFs

- SPY, DJI, QQQ, SPX, XSP, RUT

- Select stocks requested by customers

Cash Secured Puts and Covered Calls Screener Data

Here is a quick breakdown of the columns and their meanings:

Symbol

The stock ticker symbol for the underlying stock

Expiration

The date when the option expires

Strike

The strike price of the put option - the price at which you would buy the stock if assigned

Prc

The premium price you receive for selling the put option

DTE

Days to expiration - how many days until the option expires

IV

Implied volatility - the market's expectation of the stock's future volatility

Delta

The sensitivity of the option price to changes in the underlying stock price

Theta

Time decay - how much the option loses value each day

Max Ret

Maximum return in dollars if the option expires worthless

Max Ret Pct

Maximum return as a percentage of the strike price

Bid/Ask

The current bid and ask prices for the option

Earnings

Upcoming earnings date that could impact the stock price

Vertical Spreads Screener Columns

The vertical spreads screener displays these data columns:

Symbol

The stock ticker symbol for the underlying stock

Expiration

The date when both options expire

Put/Call

Whether the spread uses put options or call options

Strike1

The strike price of the short option (option you sell)

Strike2

The strike price of the long option (option you buy)

Prc

The net premium you receive for the spread

DTE

Days to expiration - how many days until both options expire

IV

Implied volatility of the short option

Delta

The delta of the short option

Max Ret

Maximum return in dollars if the spread expires with maximum value

Max Ret Day

Maximum return per day - useful for comparing trades with different time frames

Max Ret Pct

Maximum return as a percentage of the maximum loss

Max Loss

Maximum loss in dollars if the spread expires with maximum loss

Break Even

The stock price at which the spread breaks even at expiration

Earnings

Upcoming earnings date that could impact the stock price

Delta Range Strategy Guide

Delta ranges correspond to different risk levels and strategies:

- 0.05-0.20: Low probability of assignment, lower premiums, safer for beginners

- 0.20-0.35: Moderate probability of assignment, balanced risk and reward

- 0.35-0.50: Higher probability of assignment, higher premiums, more aggressive

- 0.20-0.50: Wide range covering moderate to aggressive strategies

Sample Trades from the Screener

Cash Secured Put Trades:

SELL -1 AAPL 18 JUL 25 175.0 PUT @2.15 LMTSELL -1 MSFT 25 JUL 25 380.0 PUT @3.40 LMTSELL -1 NVDA 01 AUG 25 900.0 PUT @12.50 LMTSELL -1 TSLA 11 JUL 25 230.0 PUT @5.80 LMTSELL -1 GOOGL 18 JUL 25 160.0 PUT @2.90 LMTCovered Call Trades:

SELL -1 AAPL 18 JUL 25 185.0 CALL @1.25 LMTSELL -1 MSFT 25 JUL 25 420.0 CALL @2.10 LMTSELL -1 NVDA 01 AUG 25 1050.0 CALL @8.30 LMTSELL -1 TSLA 11 JUL 25 270.0 CALL @3.90 LMTSELL -1 GOOGL 18 JUL 25 180.0 CALL @1.80 LMTVertical Spread Trades:

SELL -1 AAPL 18 JUL 25 175.0 PUT @2.15 LMT; BUY -1 AAPL 18 JUL 25 170.0 PUT @1.45 LMTSELL -1 MSFT 25 JUL 25 380.0 PUT @3.40 LMT; BUY -1 MSFT 25 JUL 25 375.0 PUT @2.80 LMTSELL -1 NVDA 01 AUG 25 900.0 PUT @12.50 LMT; BUY -1 NVDA 01 AUG 25 890.0 PUT @10.20 LMTSELL -1 TSLA 11 JUL 25 230.0 PUT @5.80 LMT; BUY -1 TSLA 11 JUL 25 225.0 PUT @4.60 LMTSELL -1 GOOGL 18 JUL 25 160.0 PUT @2.90 LMT; BUY -1 GOOGL 18 JUL 25 155.0 PUT @2.30 LMTThese trades can be copied directly into the Think or Swim platform for execution. Each trade represents an opportunity identified by Tiblio's screener algorithm.

The screener updates every minute during market hours to provide fresh opportunities based on current market conditions and volatility levels.