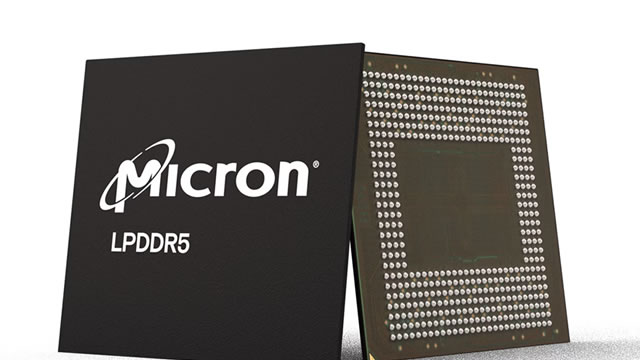

Micron Technology, Inc. (MU)

Automate Your Wheel Strategy on MU

With Tiblio's Option Bot, you can configure your own wheel strategy including MU - and automate your put writes, covered calls, and full wheel strategy. Just connect one of the supported brokerages: tastytrade, Schwab, TradeStation or Tradier and go.

Start Your Free Trial NowKey Metrics & Ratings

- symbol MU

- Rev/Share 37.6107

- Book/Share 52.272

- PB 8.3754

- Debt/Equity 0.2124

- CurrentRatio 2.4598

- ROIC 0.1628

- MktCap 492747954466.0

- FreeCF/Share 10.5893

- PFCF 41.3622

- PE 41.3574

- Debt/Assets 0.1453

- DivYield 0.0011

- ROE 0.2243

- Rating B+

- Score 3

- Recommendation Neutral

- P/E Score 2

- DCF Score 3

- P/B Score 2

- D/E Score 3

Recent Analyst Ratings

| Type | Ticker | Analyst Firm | Previous Rating | Current Rating | Previous Price Target | Current Price Target | Date |

|---|---|---|---|---|---|---|---|

| Reiterated | MU | HSBC Securities | -- | Buy | $350 | $500 | Jan. 23, 2026 |

| Initiation | MU | William Blair | -- | Outperform | -- | -- | Jan. 22, 2026 |

| Reiterated | MU | TD Cowen | -- | Buy | $300 | $450 | Jan. 20, 2026 |

| Reiterated | MU | Barclays | -- | Overweight | $275 | $450 | Jan. 16, 2026 |

| Initiation | MU | RBC Capital Mkts | -- | Outperform | -- | $425 | Jan. 15, 2026 |

| Reiterated | MU | UBS | -- | Buy | $300 | $400 | Jan. 7, 2026 |

| Reiterated | MU | Bernstein | -- | Outperform | $270 | $330 | Jan. 2, 2026 |

| Upgrade | MU | BofA Securities | Neutral | Buy | -- | $300 | Dec. 18, 2025 |

| Reiterated | MU | TD Cowen | -- | Buy | $275 | $300 | Dec. 18, 2025 |

| Reiterated | MU | Needham | -- | Buy | $200 | $300 | Dec. 16, 2025 |

News

Why Wall Street Expects Micron to Crush Earnings Today — And Its Stock to Surge Again

Published: December 17, 2025 by: 24/7 Wall Street

Sentiment: Positive

Micron Technology ( NASDAQ:MU ) is scheduled to release its fiscal first-quarter earnings today after the market closes, and Wall Street is expecting nothing short of spectacular.

Read More

Micron's Monster 2025 Run Meets Its Biggest Quarter Yet — And The Stock Is Slipping

Published: December 17, 2025 by: Benzinga

Sentiment: Neutral

Micron Technology Inc.'s (NASDAQ: MU) stock is sliding into first quarter earnings — not because the AI memory story is cracking, but because expectations have finally caught up. After a 166% year-to-date rally, MU is coming off its highs, down nearly 9% over the past five days, setting up what may be the most consequential quarter of the cycle.

Read More

5 Things to Know Before the Stock Market Opens

Published: December 17, 2025 by: Investopedia

Sentiment: Negative

Stock futures are ticking higher this morning as the market looks to rebound from a recent slump fueled by concerns about an AI bubble; memory chip maker Micron Technology is slated to release its quarterly results after the closing bell; OpenAI is reportedly in talks to get $10 billion or more in new investment from Amazon; Tesla shares come into today's session fresh off their first record closing high in a year; and Warner Bros. Discovery is urging its shareholders to reject the takeover offer from Paramount Skydance.

Read More

Buy Micron Stock, Analyst Says. Look at Soaring Memory Chip Prices.

Published: December 16, 2025 by: Barrons

Sentiment: Positive

The company has become a key supplier of high-bandwidth memory.

Read More

Micron Slips Ahead of Earnings: Is the AI Memory Demand Priced In?

Published: December 16, 2025 by: Zacks Investment Research

Sentiment: Neutral

Micron has delivered one of the year's most impressive performances, with shares rising more than 180% year-to-date.

Read More

4 Tech Stocks That Doubled in 2025 With More Room to Run

Published: December 16, 2025 by: Zacks Investment Research

Sentiment: Positive

MU, CLS, COMM and ASTS have more than doubled in 2025, powered by AI, 5G and space-based network innovations.

Read More

Micron price target boosted ahead of earnings on memory pricing rebound, favorable margin outlook

Published: December 15, 2025 by: Proactive Investors

Sentiment: Positive

Micron Technology Inc (NASDAQ:MU) has earned a price target lift from Wedbush analysts ahead of its fiscal first quarter earnings on Wednesday, with the firm pointing to stronger-than-expected improvements in memory industry pricing and a more favorable margin outlook. The firm raised its 12-month price target on the chipmaker to $300 from $220 while reiterating an ‘Outperform' rating.

Read More

Micron Needs To Deliver Excellence, Or Else (Rating Downgrade)

Published: December 15, 2025 by: Seeking Alpha

Sentiment: Neutral

I'm downgrading Micron Technology, Inc. to a Hold ahead of its fiscal Q1 '26 release, despite strong AI-driven fundamentals and a 186.5% YTD rally. MU's pivot from consumer to enterprise DRAM/HBM, driven by AI and data center demand, supports a structurally bullish long-term thesis. DRAM and NAND pricing is surging amid supply constraints, but MU's near-term risk-reward is unfavorable given high expectations and recent sector volatility.

Read More

Final Full Trading Week of 2025 Filled with Data

Published: December 15, 2025 by: Zacks Investment Research

Sentiment: Neutral

Delayed jobs and inflation reports will finally be in focus, along with normal-cycle economic reports in this last full trading week of the year and a few off-season earnings reports.

Read More

AI-Fueled Demand to Boost Micron Technology's DRAM Revenues in Q1

Published: December 15, 2025 by: Zacks Investment Research

Sentiment: Positive

MU's DRAM revenues are likely to surge 58% year over year in Q1 as AI workloads boost demand for high-performance memory.

Read More

Micron Technology: The Stakes for Wednesday's Earnings Report (Part 1)

Published: December 15, 2025 by: FXEmpire

Sentiment: Neutral

Wall Street expects Micron to report earnings per share between $3.77 and $3.94, representing more than double the $1.79 posted in the same period last year.

Read More

Trade Tracker: Kevin Simpson buys Micron and Applied Materials

Published: December 12, 2025 by: CNBC Television

Sentiment: Positive

Kevin Simpson, Capital Wealth Planning founder and CIO, joins CNBC's 'Halftime Report' to detail his latest buys.

Read More

Final Trades: Micron, Palo Alto Networks, Adobe and Vertiv Holdings

Published: December 12, 2025 by: CNBC Television

Sentiment: Neutral

The Investment Committee give you their top stocks to watch for the second half.

Read More

Why Micron (MU) is a Top Stock for the Long-Term

Published: December 12, 2025 by: Zacks Investment Research

Sentiment: Positive

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

Read More

Unlocking Q1 Potential of Micron (MU): Exploring Wall Street Estimates for Key Metrics

Published: December 12, 2025 by: Zacks Investment Research

Sentiment: Neutral

Get a deeper insight into the potential performance of Micron (MU) for the quarter ended November 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Read More

Here is What to Know Beyond Why Micron Technology, Inc. (MU) is a Trending Stock

Published: December 12, 2025 by: Zacks Investment Research

Sentiment: Positive

Zacks.com users have recently been watching Micron (MU) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Read More

Micron: Why The Stock's Valuation Suddenly Looks Cheaper? (Rating Upgrade)

Published: December 11, 2025 by: Seeking Alpha

Sentiment: Positive

I upgraded MU to a Strong Buy after its 180% YTD rally, as its forward non-GAAP P/E fell to 14x, down from 16x in my last rating. The cheaper valuation is driven by significant upward revisions to forward revenue and earnings consensus. MU's revenue growth continues to accelerate into FY2026, supported by a significant jump in gross margin and triple-digit EPS growth in 1Q FY2026.

Read More

Micron Technology, Inc. (MU) Hit a 52 Week High, Can the Run Continue?

Published: December 11, 2025 by: Zacks Investment Research

Sentiment: Positive

Micron (MU) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Read More

Why analysts think there is more to come in Micron's rally?

Published: December 11, 2025 by: Invezz

Sentiment: Positive

Micron Technology's stock continues its rapid ascent, hitting fresh all-time highs this week as Wall Street analysts raise their expectations ahead of the company's fiscal first-quarter earnings report on December 17.

Read More

Micron Technology: AI HBM Premium Drives DRAM Pricing And Justifies A Strong Buy

Published: December 10, 2025 by: Seeking Alpha

Sentiment: Positive

Micron Technology, Inc. remains a Strong Buy, driven by robust HBM and DRAM pricing from AI hardware demand. MU's Q1 2026 sales are expected to reach $12.7B, with 46% YoY growth and EPS at the high end of guidance. EBITDA and free cash flow estimates for MU have surged, supporting price targets with 54–81% upside potential.

Read More

Micron (MU) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Published: December 10, 2025 by: Zacks Investment Research

Sentiment: Positive

Micron (MU) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Read More

Micron Technology Shares Rise 3% After Key Trading Signal

Published: December 09, 2025 by: Benzinga

Sentiment: Positive

Micron Technology Inc (NASDAQ: MU) experienced a significant Power Inflow alert, a key bullish indicator that is closely tracked by traders who value order flow analytics, specifically institutional and retail order flow data. At 10:08 AM EST on December 9th, MU triggered a Power Inflow signal at a price of $248.66.

Read More

Best Growth Stocks to Buy for December 8th

Published: December 08, 2025 by: Zacks Investment Research

Sentiment: Positive

MU, GLDD and ALRM made it to the Zacks Rank #1 (Strong Buy) growth stocks list on December 8, 2025.

Read More

Micron vs. Lam Research: Which Stock Has Better Upside Potential?

Published: December 08, 2025 by: Zacks Investment Research

Sentiment: Positive

MU's faster growth estimates, stronger AI momentum and lower valuation than LRCX point to clearer upside.

Read More

Buy 5 Growth Stocks for December to Strengthen Your Portfolio

Published: December 05, 2025 by: Zacks Investment Research

Sentiment: Positive

MU, FIX, KGC, ONON and MDB are five growth picks showing strong revenue and earnings growth heading into December.

Read More

Brokers Suggest Investing in Micron (MU): Read This Before Placing a Bet

Published: December 04, 2025 by: Zacks Investment Research

Sentiment: Neutral

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Read More

Micron: Why An Exit From Consumer Isn't Scary

Published: December 04, 2025 by: Seeking Alpha

Sentiment: Negative

Micron Technology, Inc. announced that it'll exit its consumer business by February 2026 to prioritize AI-driven memory demand and capitalize on industry-wide shortages. The market was confused about how to understand the news; our take is that this won't negatively impact MU, considering consumer is not what's driving the company's outperformance. Instead, that would be DRAM, and HBM in specific, where MU holds the second-largest market cap after SK Hynix at 21%.

Read More

Micron Technology Soars 178% YTD: Should You Still Buy the Stock?

Published: December 04, 2025 by: Zacks Investment Research

Sentiment: Positive

Strong financial performance, AI-driven momentum and low valuation multiples spark fresh interest in MU stock despite a YTD surge of 178%.

Read More

Micron stops selling memory to consumers as demand spikes from AI chips

Published: December 03, 2025 by: CNBC

Sentiment: Positive

Micron said on Wednesday that it plans to stop selling memory to consumers to focus on providing enough memory for high-powered AI chips. "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments," Sumit Sadana, Micron business chief, said in a statement.

Read More

3 Well-Positioned AI Stocks From Steven Cress

Published: December 03, 2025 by: Seeking Alpha

Sentiment: Positive

Micron Technology (MU), CommScope (COMM), and Seagate (STX) are top quant strong buys in the AI sector, exhibiting sector-leading fundamentals and attractive valuations. MU trades at a 50% PE discount to sector peers with 36% forward revenue and 191% EPS growth, while analyst revisions remain overwhelmingly positive.

Read More

About Micron Technology, Inc. (MU)

- IPO Date 1984-06-01

- Website https://www.micron.com

- Industry Semiconductors

- CEO Sanjay Mehrotra

- Employees 48000