The Horizon email list is typically an email that I send out about twice per week detailing trades that I'm taking. As you know from previous emails, since July 4th, I liquidated the majority of the trades that I had for a few reasons, most notably the market pushed to new all time highs and the Trump factor was weighing on me with regards to tariffs and other activities.

Wow, since that weekend, roll forward and the market is currently up 9.1% YTD and 16.5% over 1 year.

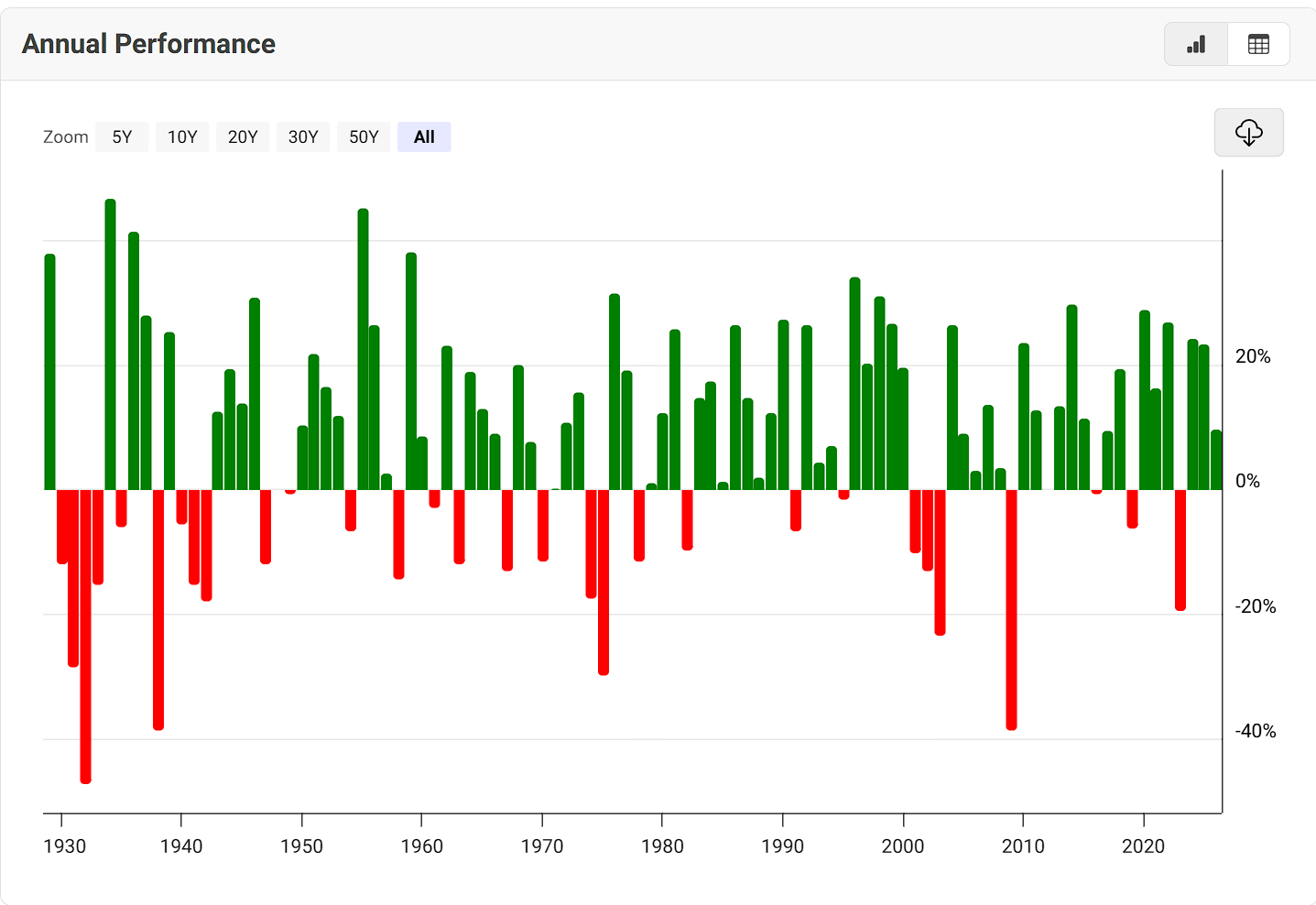

That is following a staggering climb given basically back to back 20% returns since 2019 except for 2022 which feels like a modest correction if any correction at all.

Looking back the time period that looks most familiar to this is 1995-1999 - the market consistently delivered 20+% returns and what followed in 2000 and 2001 was the dot com bubble burst.

What else is standing out to me right now is AI. It sounds a lot like the dot com bubble which also sounds a lot like the Tulip craze of the whatever, 1634 to 1637.

Another interesting thing to have a look at is that the S&P 500 may be now be considered to NOT be diversified. At least not as much as one would expect given how it is discussed as a broad market index.

What do you notice about the top 10 holdings? Aside from the fact that 10 holdings make up ~40% of an index of 500+ companies. Of course by any measure, that indicates that it is NOT DIVERSIFIED right there.

That's right, it is basically the Magnificent 7 stocks.

And what are the Mag-7 doing?

AI.

Finance is an interesting beast. On the one hand, every disclaimer says "the past is not predictive of the future", and yet, the past does tend to repeat itself in strange ways.

All of this to say, this is why I'm nervous about the market and should not be taken as financial advice or anything else. I'm not saying go sell everything. But with all of this one does have to wonder.

Are we in an AI bubble?

When I ask around my friends how many AI services they are paying for...

The answer is usually 0

A big fat nada.

Sure, engineers are paying for them, and we're paying increased fees at Google for email accounts for example. I'm sure Microsoft is baking in additional fees or fee hikes to justify AI. But by and large, the verdict is still out on whether or not these huge bets to the tune of 350 BILLION DOLLARS in 2025 will pay out dividends in the form of increased revenue.

And the Mag 7 is a bit incestuous. Who benefits from that massive spend? NVDA.

So event though they aren't -spending- once the chips fall, well, the chips fall.

and where are the chips? SMH the semiconductor ETF is up over 148% over 3 years.

So my concern is that even if AI crushes it, as the internet did, there may be a nearer term bubble bursting effect. And I would like to have some cash sitting around to take advantage of it. Again, this is just me, and this perspective has cost me to lose out on the market surge from July 4th to now.

-

Ok so that's the main reason why I haven't been sending out the Horizon list emails on the regular.

Another reason is that we've been working on a simulated portfolio that you should be receiving emails for. We're calling it Slow Burn because we sell put options and profit from the slow time decay measured by Theta, one of the options Greeks.

We recently made a couple of updates:

More Data in Email

There is now much more data in the email including the earnings dates to help provide more information on trades.

Penalties

We're now penalizing companies when we experience a losing trade. The penalty is pretty stiff and just like Theta, decays over time back to 0. The penalty is used to push the stock further down the list of acceptable trades for the day. Any stock with a penalty over 100 is excluded entirely.

Upcoming! We're going to start publishing the list of penalized stocks.

We're also gathering these stats and are putting together a full experience dashboard so you can see how the simulated portfolio is performing, which, I hope is a window into what it is really like selling put options at scale, because it isn't how it is portrayed in YouTube videos where someone just magically sold puts on some company and doubled their portfolio value.

That's all for today! Please give me feedback on this newsletter, share your thoughts or just use the thumbs up and thumbs down buttons below.

In 2026, the 300bln invested in 2025 will be worth only 200bln.

Closing thought, I wonder if those chips are "non returnable" after they're plugged in, same clause I see in Amazon when I buy new computer parts.

Happy Monday,

Kevin