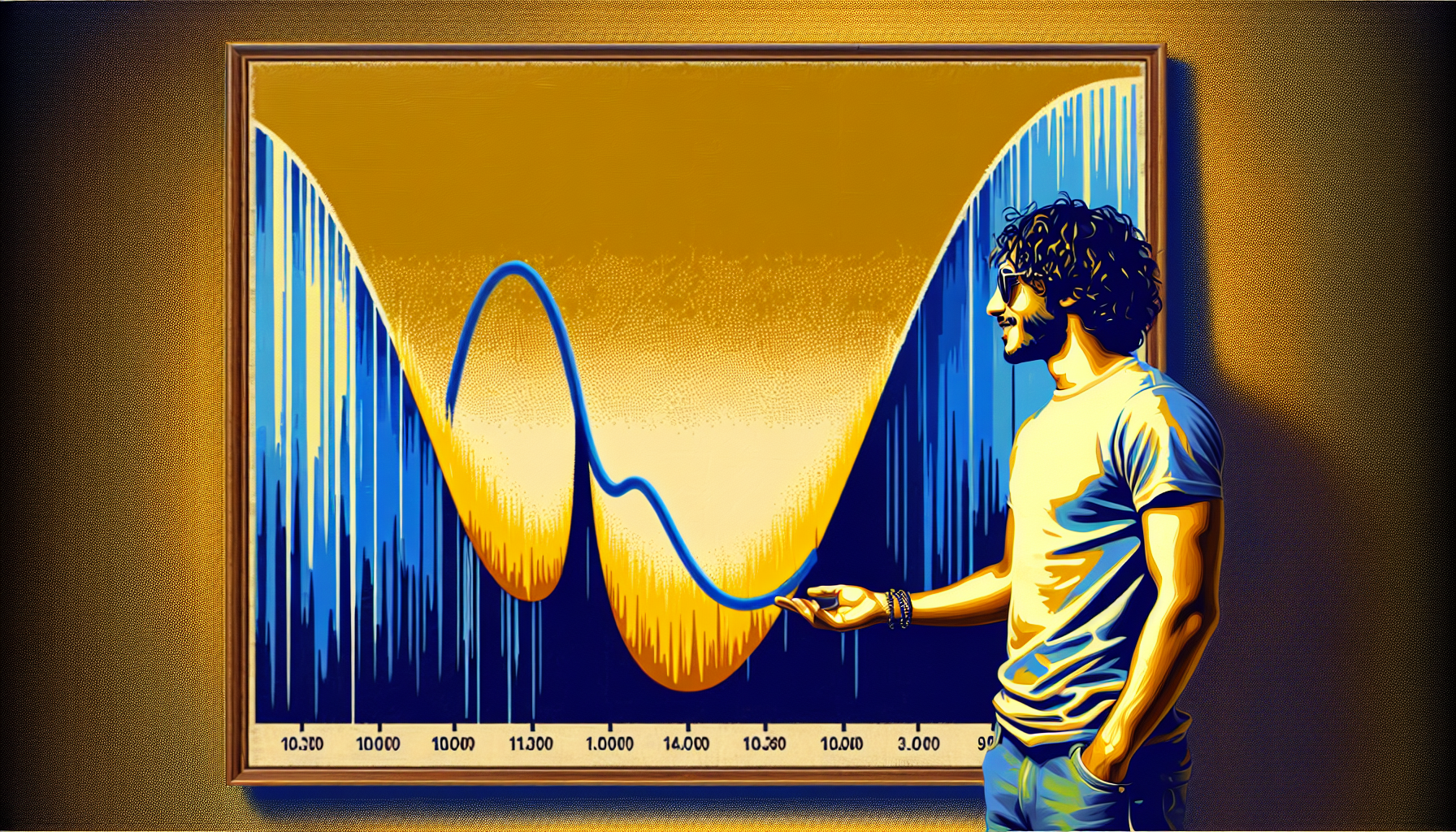

Have you ever heard of the volatility smile in finance lingo? This term refers to a graphical representation of the implied volatility of options, plotted against the strike prices. The curve typically shows that options with different strike prices but the same expiration date can have different implied volatilities. Essentially, it depicts how the market perceives the potential risk and uncertainty of various options.

The shape of the volatility smile can provide valuable insights for investors and traders. In a typical market environment, the volatility smile tends to be u-shaped or skewed. This means that either at-the-money options (with strike prices close to the current market price) or far out-of-the-money options (with strike prices significantly above or below the market price) tend to have higher implied volatilities compared to options at other strike prices. This skewness reflects market participants' expectations of potential large price movements in the underlying asset.

There are several theories as to why the volatility smile exists. One explanation is the impact of supply and demand dynamics in the options market. Market participants might be willing to pay higher prices for options that protect against extreme market movements, leading to higher implied volatilities for these options. Another theory attributes the volatility smile to changes in investor sentiment and the pricing of risk in the market.

For traders, understanding the volatility smile is crucial for various reasons. Firstly, it can affect the pricing and profitability of options trading strategies. Traders might use the information from the volatility smile to adjust their trading approach based on market expectations. Furthermore, the volatility smile can also provide insights into potential upcoming market events or shifts in investor sentiment.

Overall, the volatility smile is a key concept in the world of options trading and derivative pricing. By analyzing the shape and dynamics of the volatility smile, traders and investors can gain a deeper understanding of market expectations and better position themselves to navigate the complexities of financial markets.

Ready to explore more about options trading and financial derivatives? Join Tiblio and take your trading skills to the next level! Join Tiblio